remont-samim.ru Prices

Prices

Refinance Checklist Questions

This is the most important question to ask yourself if you are considering a refinance. The answer will help influence the decisions you make for the remainder. You'll need to provide your lender with proof of income to qualify for a mortgage refinance. Documents like W-2s, pay stubs and tax returns can help your lender. Questions? For general questions about mortgage, refinance or home equity loans call our contact center or email [email protected] Know when to refinance your home loan. Have interest rates dropped? Has your credit score improved? Has your home's value increased? Looking for new loan. (Answers to ALL of the questions listed below must be “Yes” in order to Copy of note being refinanced- including any modification agreements - and. Check out our resources for refinancing, including an application checklist and commonly asked questions to learn more about the process. Refinance Checklist · Most recent pay stubs · Copies of your personal and business federal income tax returns from the last two years · W-2 forms for the past two. Refinance Checklist · Most recent month's pay stubs (originals) · W-2 forms—past 2 years' (copies) · Income tax return information, especially if self-employed—. Refinance Checklist · Checking, savings, or stock accounts; K information; etc. (copies) · Current credit score and reports · Debt data such as credit card or. This is the most important question to ask yourself if you are considering a refinance. The answer will help influence the decisions you make for the remainder. You'll need to provide your lender with proof of income to qualify for a mortgage refinance. Documents like W-2s, pay stubs and tax returns can help your lender. Questions? For general questions about mortgage, refinance or home equity loans call our contact center or email [email protected] Know when to refinance your home loan. Have interest rates dropped? Has your credit score improved? Has your home's value increased? Looking for new loan. (Answers to ALL of the questions listed below must be “Yes” in order to Copy of note being refinanced- including any modification agreements - and. Check out our resources for refinancing, including an application checklist and commonly asked questions to learn more about the process. Refinance Checklist · Most recent pay stubs · Copies of your personal and business federal income tax returns from the last two years · W-2 forms for the past two. Refinance Checklist · Most recent month's pay stubs (originals) · W-2 forms—past 2 years' (copies) · Income tax return information, especially if self-employed—. Refinance Checklist · Checking, savings, or stock accounts; K information; etc. (copies) · Current credit score and reports · Debt data such as credit card or.

Attached is a checklist of documents needed for your loan application. Please contact us at () with any questions. Submission Options. If you own any real estate (other than the property you're refinancing), we'll have some basic questions including, address, current market value, the amount. The facts you need before you decide to refinance. When should you consider refinancing? What are some reasons to refinance? How much home equity can you. When you apply for your loan, you'll be able to upload key documents to verify your income, assets, debts and other information. Having these documents on hand. Use this mortgage refinance checklist to see what documents you need to refinance and make the process as easy as possible. checklist that will inform you of all the documents needed to refinance your mortgage questions regarding the conditional approval or status of your loan. Call, fax or e-mail us with any questions you may have. ALL OWNERS MUST ATTEND CLOSING, EVEN IF HE/SHE IS NOT ON THE LOAN DOCUMENTS. Offices. North of The. The TFCU Auto Refinance Checklist will help you get started with answers to common questions. The auto refinancing process is a little different from. any paperwork you'll need;. cost versus benefit considerations;. your refinancing options; and. the different reasons for refinancing. Download the refinance. loan officer, the better equipped your mortgage advisor will be to answer any questions you may have.. Standard Documentation. Copy of Valid Driver's. Refinance Checklist. Based upon the type If you own any real estate (other than property you're refinancing), we'll have some basic questions including. If there are questions regarding any of the items on this list, please promptly call or e‐mail your loan officer for assistance. Copy of Driver's License. The facts you need before you decide to refinance. When should you consider refinancing? What are some reasons to refinance? How much home equity can you. How can I exercise my Right to Cancel (refinance only)?. If you're unable to get the rest of your closing documents in advance, take the list of questions above. How much money you can save by refinancing your mortgage · The differences between second mortgages and home equity lines of credit · How to compare interest. Refinance Questions · What is Refinancing? Refinancing is simply getting one loan to pay off another. · What does refinancing cost? · What are points? · How does. Loan Purpose and Property Use. Is this mortgage for a home purchase or refinance? Is it an investment property? Do you plan to live in the house. How long do you plan to stay in the home? There are expenses associated with any home refinance loan, which include various application and lenders' fees, title. Checklist), fees and evaluation of the property value (appraisal) that an It's important to ask yourself some questions before considering a refinance.

Nyc Condo Mortgage Rates

Get the latest mortgage rates for purchase or refinance from reputable lenders at remont-samim.ru®. Simply enter your home location, property value and loan amount. Condos tend to be more expensive than co-ops. The data shows that right now, the median price for a Manhattan condo is $2 million. Why are condos more expensive. Today's mortgage rates in New York are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check out. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. As of Thursday, September 12, , current interest rates in New York are % for a year fixed mortgage and % for a year fixed mortgage. Shop. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. The average New York rate for a fixed year mortgage is % (Zillow, Jan. ). New York Jumbo Loan Rates. New York county conforming loan limits are. Today's mortgage rates in Brooklyn, undefined are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Condo, NY Mortgage Rates. Current rates in Condo, New York are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Get the latest mortgage rates for purchase or refinance from reputable lenders at remont-samim.ru®. Simply enter your home location, property value and loan amount. Condos tend to be more expensive than co-ops. The data shows that right now, the median price for a Manhattan condo is $2 million. Why are condos more expensive. Today's mortgage rates in New York are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check out. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. As of Thursday, September 12, , current interest rates in New York are % for a year fixed mortgage and % for a year fixed mortgage. Shop. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. The average New York rate for a fixed year mortgage is % (Zillow, Jan. ). New York Jumbo Loan Rates. New York county conforming loan limits are. Today's mortgage rates in Brooklyn, undefined are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Condo, NY Mortgage Rates. Current rates in Condo, New York are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM.

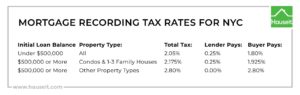

State of New York Mortgage Agency (SONYMA). Development Resources. Community Here are some of the program's features: • Competitive fixed interest rate loans. Current 30 year-fixed mortgage rates are averaging: %. The interest rates for condo mortgages are generally higher than for single Our client, who recently moved with his family from New York to South. The current average year fixed mortgage rate in New York remained stable at %. New York mortgage rates today are 11 basis points lower than the national. Compare New York mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare New York mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Mortgages. LES People's is a Leader in Financing Affordable Housing in NYC Since If you are looking for a Mortgage for a family home, condo or co-op. Use SmartAsset's free New York mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Our mortgage calculator can help you determine what your monthly mortgage may be. Use this calculator to figure out what you will pay each month for your. Mortgages over $, for family residential unit and individual residential condo units = %. Mortgages on all other property over $, = %. Top 5 Originators in New York. %. US Bank. %. Quicken Loans ; Originations by Property Type. %. Single Family. %. Condo ; Originations by Loan. Find and compare condo mortgage rates and choose your preferred lender. Check rates today to learn more about the latest condo mortgage rates. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. SONYMA has two primary mortgage programs, Achieving the Dream and Low Interest Rate. Both programs are outlined on this page and are designed to help you find. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Cash you can pay when you close. Loan Amount. Mortgage Interest Rate. Varies depending on lender and credit score. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Find New York City apartments for rent and for sale at StreetEasy. StreetEasy is a Real Estate Search Engine for apartments and real estate in Manhattan and. I am just looking at rates, and - of course - bank make a distinction between single-family homes and condos, but they don't list co-ops.

1 2 3 4 5